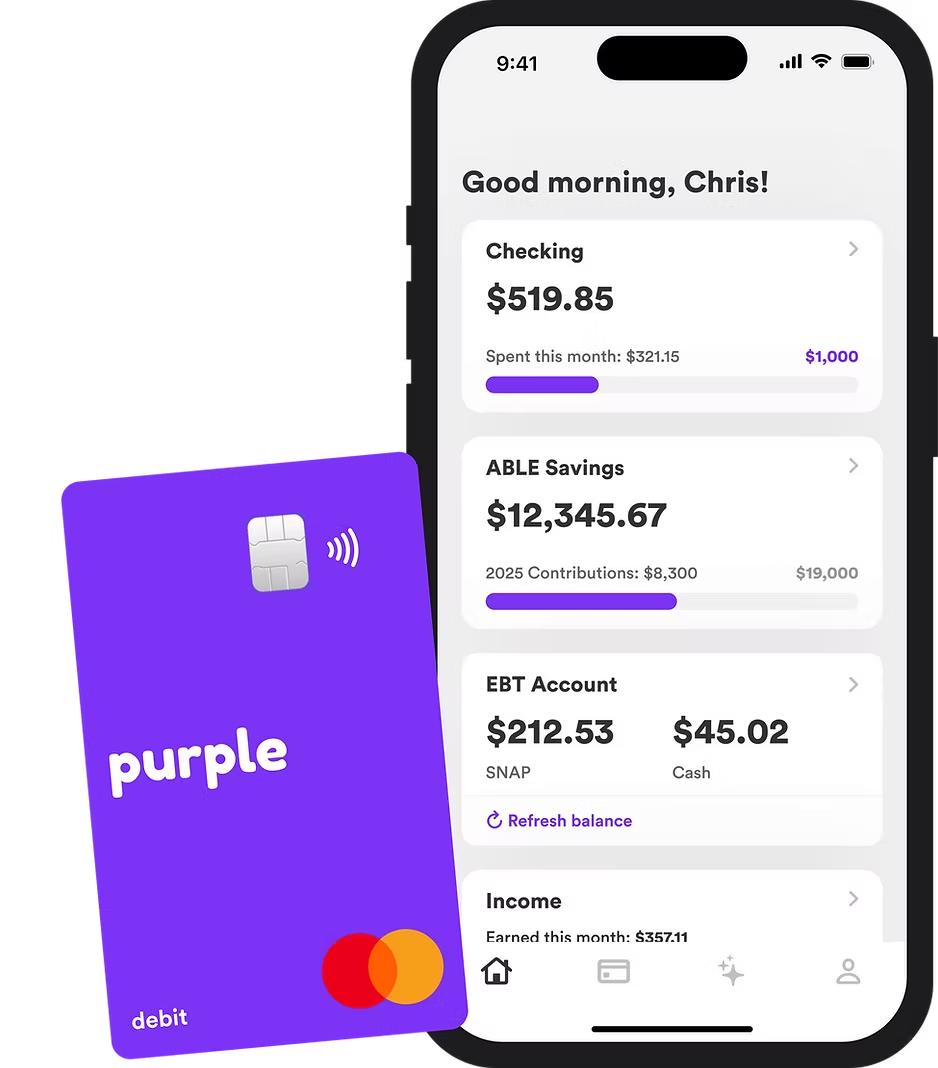

A checking account that protects your benefits

Purple Checking is designed for those receiving SSI or SSDI, so you can manage money without putting your benefits at risk

Purple is a financial technology company, not a bank. Banking services are provided by OMB Bank, Member FDIC.

Built for those receiving SSI and SSDI

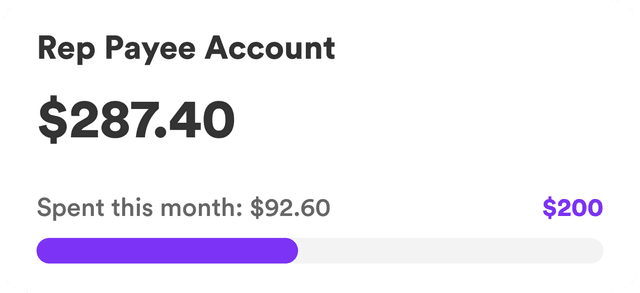

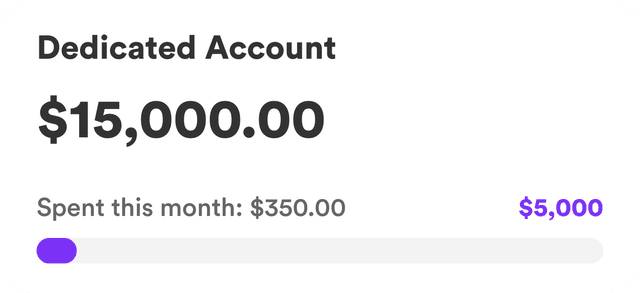

Set up accounts the right way

Open standard, rep payee, and backpay accounts structured correctly for SSI and SSDI from day one

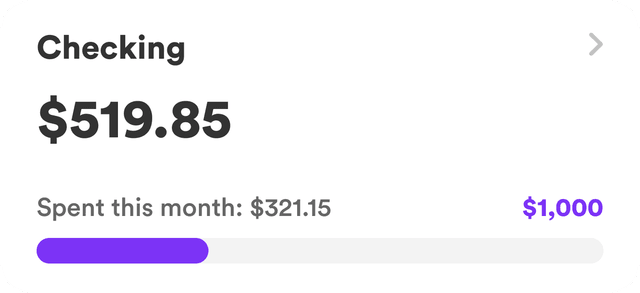

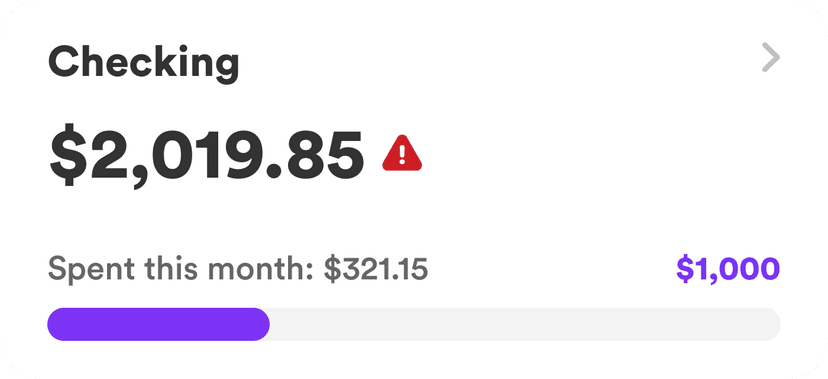

Stay under the $2,000 limit

View your Purple Checking balance in real time, with alerts when it approaches standard SSI asset thresholds

Track income deposits in real-time

Income-like deposits into Purple are identified and surfaced so changes don't go unnoticed

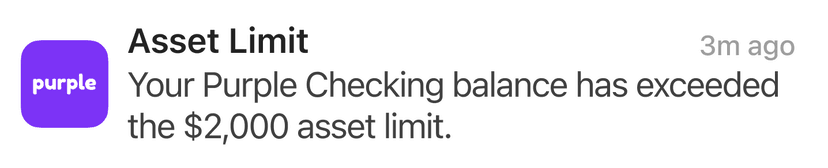

Control spending without cutting off access

Set daily, weekly, monthly and category-specific limits while still using your debit card normally

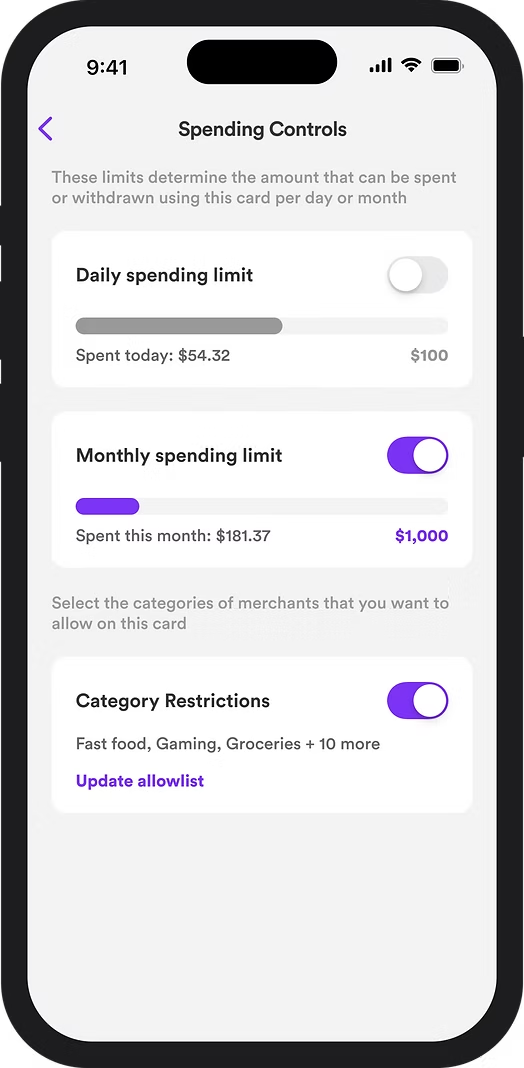

Keep records for SSA reviews

Snap receipts and store documents alongside transactions so records are there when you need them

Everything you need in a checking account

Purple Debit Card

A Mastercard debit card accepted everywhere. Use it for purchases, bill pay, and ATM withdrawals

Direct deposit

Set up direct deposit for your benefits, paycheck, or any recurring income

Real human support

Questions? Our team understands benefits and is here to help

No monthly fees

No minimum balances. Just straightforward banking

Mobile check deposit

Coming soonDeposit checks from your phone. Just snap a photo and the funds are on their way

Bill pay

Coming soonPay bills directly from your Purple account. Set up one-time or recurring payments

Built by people who manage disability benefits for their families

Join thousands of families who trust Purple to protect their benefits

Purple is a financial technology company, not a bank. Banking services are provided by OMB Bank, Member FDIC.