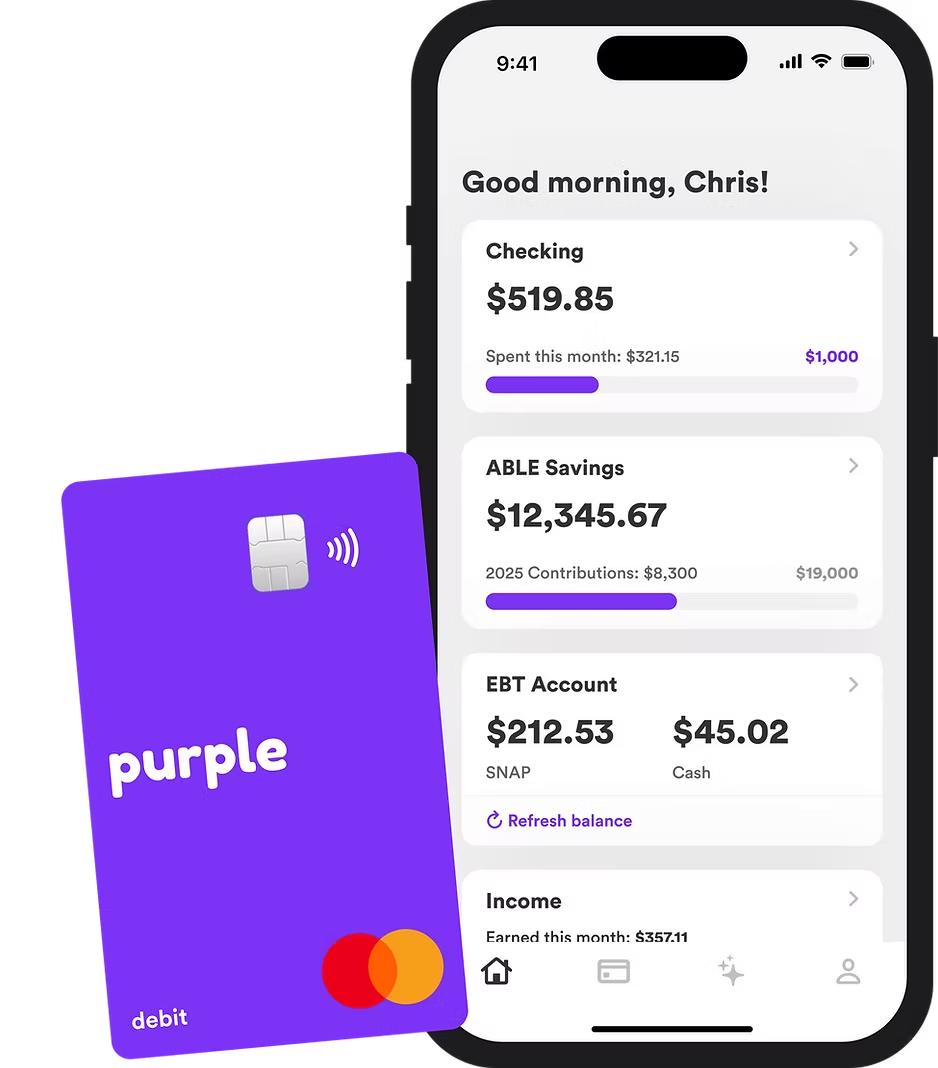

Banking built to protect your disability benefits

Purple helps individuals with disabilities manage money safely, with built-in monitoring and guardrails to reduce the risk of SSI or SSDI disruption

- Receive benefits up to 4 days early¹

- Guided account setup aligned with SSA benefit requirements

- Automatic alerts as you approach asset and income limits

- Spending controls with caregiver visibility

- No monthly fees. No minimums

Purple is a financial technology company, not a bank. Banking services are provided by OMB Bank, Member FDIC.

THE PROBLEM

Managing money on benefits is harder than it should be

Difficult to set up benefits

Most banks aren't built for disability benefits, making it easy to open the wrong accounts or handle funds incorrectly

The financial cliff

Strict asset and income limits mean going $1 over can put thousands of dollars of benefits at risk

No clear guidance

Benefit rules are confusing and ever-changing, leaving you guessing on what's safe and what actions to take

THE SOLUTION

Benefits-aware banking, designed to prevent mistakes before they happen

- Standard and rep payee accounts

- Dedicated backpay accounts

- SSA-aligned setup guidance

- Track against SSI / SSDI limits

- Early alerts before thresholds are crossed

- Debit cards for daily spending

- Daily, weekly, and monthly limits

- Category-based controlsComing soon

- Receipts and documents stored alongside transactions

- Transaction-receipt linking for easy lookup

- Shared visibility for families and caregivers

- Role-based permissions

- Integrated ABLE setup and management

- Smart guidance on qualified disability expenses (QDEs)

- Auto-sweeps to stay under asset limit

The system wasn't built for you

Traditional banking ignores the unique challenges of managing money while on benefits

lose benefits annually

in benefits lost annually

can't access $2,000 for emergencies

Explore how Purple works for you

Individuals with Disabilities

Managing your own money while on SSI or SSDI? Purple Checking helps you stay in control while reducing the risk of benefit disruptions

Learn moreFamily & Caregivers

Supporting a loved one with disability benefits? Purple helps caregivers manage money safely, stay organized, and reduce the risk of SSI or SSDI disruptions

Learn moreOrganizations

Built for representative payees, care agencies, and disability service providers managing funds at scale, with unified visibility, controls, and compliance

Learn moreBuilt by people who manage disability benefits for their families

Join thousands of families who trust Purple to protect their benefits

Purple is a financial technology company, not a bank. Banking services are provided by OMB Bank, Member FDIC.